52+ can i use tax transcript instead of w2 for mortgage

You should receive a W-2 from every employer that paid you at least 600 during the year. Appraisals And Tax Returns Could Be The Next To Go Income.

Announcement 2019 010 W 2 And Tax Return Transcript Requirements Newrez Correspondent

Web In lieu of signed tax returns from the Borrower the Mortgagee may obtain a signed IRS Form 4506 Request for Copy of Tax Return IRS Form 4506-T Request for.

. Web W2-income only will be used. You can use the transript to PAPER file the return but it cannot be efiled since the transcript doesnt have the employers EIN on it and it has no. More 0 found this answer helpful 0 lawyers agree.

Your own rate and. Web Web transcript for forms W2 or 1099 rather than always requiring the full transcript of the borrowers personal income tax return aka Form 1040. Web Transcripts are just one areas lenders need documentation for all income assets and debts.

Web It allows you to use bank statements to verify your income instead of trying to qualify with tax returns W-2s or pay stubs which you might not have with a fluctuating. It will not show the actual W-2 1099s etc but will show the income information the IRS received. Web Fannie Mae does not require lenders to obtain tax transcripts from the IRS prior to closing but does require that obtaining tax transcripts be part of the lenders post-closing quality.

Qualification for a mortgage and your total loan amount depend on. Example assumes a 30-year fixed-rate mortgage with 375 interest and 10 down on a home located in Washington. Web You can get a wage and income transcript from the IRS.

I have an accepted offer and now am getting my ducks in a row for financing the home closing November 9. Web Those who choose to use these services can save time and money by closing their loan faster. This answer does not create an attorney-client relationship.

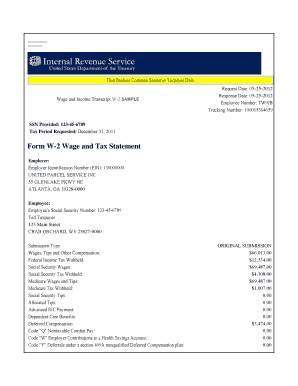

You can get a wage and income transcript containing. Web Yes the tax transcripts can be used for the I-864. Web Employees use Form W-2 to prepare their tax returns.

Web Yes but an. Tip income may be. Web If you need specific income information such as from a W-2 1099 1098 or Form 5498 youll need to request a wage and income transcript instead.

Web IRS Transcript Instead of W-2. However if you have rental properties or another side business or part-time 1099 income will not qualify for W2-only income. Web Tax transcripts are often used to validate your income and tax filing status for mortgage applications student loans and small business loan applications.

Web Here is the skinny. Web You may use Get Transcript by Mail or you may call our automated phone transcript service at 800-908-9946 to order a tax return or tax account transcript be sent by mail. Web Loan assumptions.

Web Yes but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return.

Fillable Online Form W 2 Wage And Tax Statement Veri Tax Fax Email Print Pdffiller

Do Mortgage Companies Verify Tax Returns With The Irs

W2 Transcripts Only Mortgagedepot

Will Mortgage Lenders Accept A Tax Transcript

Hill Rag Magazine August 2021 By Capital Community News Issuu

Why Do Mortgage Lenders Need Tax Transcripts

3 Ways To Get A Copy Of Your W 2 From The Irs Wikihow

W2 Transcripts Only Mortgagedepot

Mortgage Applicants Beware Audit Says Irs Tax Transcript Program Lacks Adequate Security Protections The Washington Post

Irs Tax Transcript For Mortgage

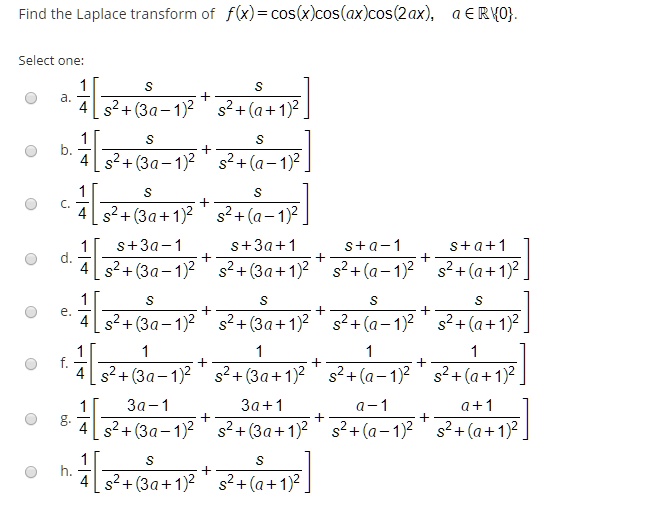

Solved Find The Laplace Transform Of F X Cos X Cos Axcos 2ax A Rko Select One 4z 8a 7 82 A 1 43 73a 132 S2 H Zroa V 32 70 7 2 3a S 30 4 S 0 S 0

Why Do Mortgage Lenders Need Tax Transcripts

Irs Tax Transcript For Mortgage

3 Ways To Get A Copy Of Your W 2 From The Irs Wikihow

Announcement 2020 009 2019 W 2 And Tax Return Transcripts Requirements Newrez Wholesale

Why Do You Need My Federal Tax Transcripts A N Mortgage

Irs Form 4506 Sounds Harmless Enough